In our Eurodoc interview series, we chat with early-career researchers and experts working on interesting projects and developing new tools for research and innovation in Europe.

In this interview, we talk with Slaven Misljencevic who is a policy officer at the European Commission focusing on cross-border pensions and the European labour market for researchers.

Why should early-career researchers think about pensions?

Pensions are not on the radar of many young people as it is seen as something that comes later in life and there are many other monetary hurdles for them to tackle first. Furthermore, pensions are often perceived as too complex and there is also a large variation in the extent to which young people trust private and public pension providers.

Despite these reasonable arguments, there are plenty of good reasons to start planning retirement at an early age. Young people have the time to convert modest pension contributions into meaningful wealth in later life. Compound growth cannot be ignored when looking at a long-term savings plan such as a pension. Starting early also allows taking more investment risk as periods of economic crises are followed by periods of economic revival.

Moreover, it is prudent to start with pension planning at an early age. Most state pension systems are pay-as-you-go (PAYG) pension schemes, meaning that current contributions are used to pay for current retirement benefits. In other words, we pay for others who are now retired and not for ourselves later. It is unclear how state pensions will look in 30 years time and young people thus need to start early with pension planning.

What types of pensions are there for early-career researchers?

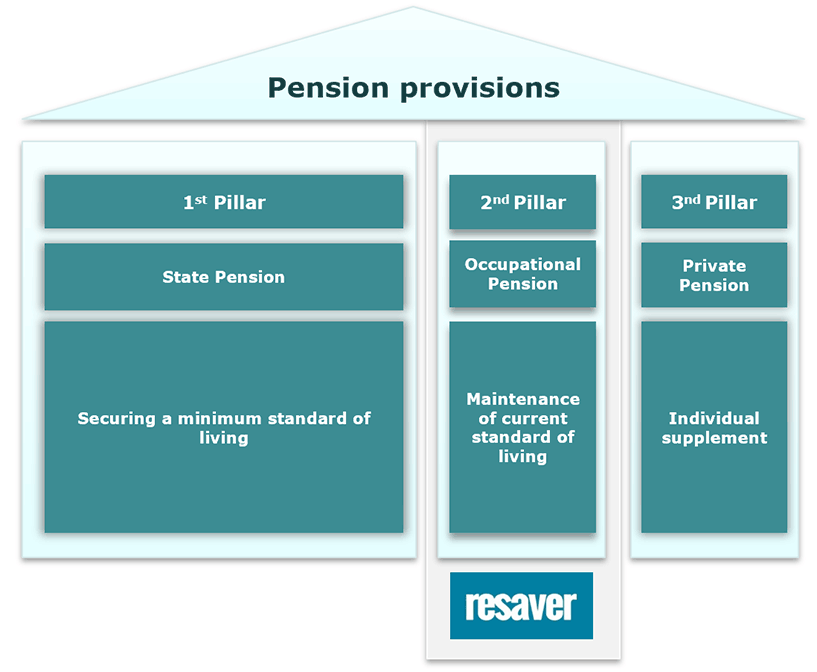

Regardless of the profession or the stage someone is in their career, retirement income is generally based on three types of schemes, also referred to as the three pension pillars. The three pillars complement each other and the importance of each pillar differs greatly from country to country.

The first pillar, also called the state pension, is the most important pillar in all member states and serves as a default means of avoiding old-age poverty. The aging population, and the effects of financial and economic crises, have put additional pressure on the sustainability of public pension schemes. To ensure adequate income for people after retirement, many member states are putting increasing emphasis on the second and third pillar pensions.

The second pillar, also called the occupational pension, is an earning-related benefit that focuses on adequate pensions in terms of replacement rate. The employer contributes an additional amount (usually a percentage of salary) to a pension fund or insurance product to which the employee will have access at retirement age. While in some member states occupational pensions form almost a standard part of the salary package, in other member states where state pensions are still strong, occupational pensions are not a market practice.

The third pillar, also called the personal pension, involves saving up for your pension. The personal pension allows individual flexibility and is often chosen to compensate insufficient retirement income from the other two pillars. Many member states incentivise the third pillar.

What issues do mobile researchers face with their pensions?

Retirement income is usually a combination of the three types of pension. Researchers are among the most mobile workers in the European Union, and as a result of their mobility, they are additionally vulnerable when it comes to acquiring an adequate mix of pension income. Mobile employees often experience issues related to occupational and personal pensions.

To start with, there is often a vesting period in occupational pension schemes: a minimum length of time an employee must receive contributions in a pension fund before being entitled to receive benefits. Mobile researchers should particularly be cautious when they work for less than three years in the same member state.

A mobile researcher is also susceptible to additional fees if they transfer their contributions from a pension scheme in one country to a pension scheme in another country. These additional fees are not always transparent and can eventually undo an important part of the returns on investment.

And as each pension scheme is subject to national labour, social, and tax laws, contributing to pension schemes in different countries can also involve additional administrative burden at retirement age. It is also possible that the access to accumulated contributions will be given at different times as retirement age differs across member states.

What is RESAVER and how does it work for researchers?

The RESAVER Pension Fund is the first multi-country and multi-employer pension fund that enables mobile researchers to stay in the same occupational pension fund when moving between different countries and changing jobs. There is consequently no vesting period, so that any contributions are secured already from the first month, and the pension fund does not charge any fees in case of transferring the assets to a local pension fund or insurance fundproduct.

As RESAVER is a non-profit organisation, and is supported by European Commission, the cost structure is competitive and usually results in higher retirement income. The online platform MyRESAVER allows beneficiaries to easily track all of their pensions contributions, carry out administrative tasks, and in some cases make investment decisions.

Nevertheless, RESAVER is not a panacea the solution for all issues mobile researchers face. Many organisations do not offer RESAVER to their employees as the pension fund is a recent development. It is thus important to ask (future) employers if they actually offer RESAVER to their employees. RESAVER is also only available in the European Economic Area.

RESAVER is now actively expanding the number of supporting employers and is working on a private pension product. Interested in learning more about RESAVER? Contact Slaven!